FINCEN BOI Reporting Requirement: What You Need to Know

The Beneficial Ownership Information (BOI) reporting requirement, enacted under the Corporate Transparency Act (CTA) in January 2021, is now in effect and businesses must comply by January 1, 2024. This regulation mandates that U.S. corporations, limited liability companies (LLCs), and other entities disclose the identities of their beneficial owners—the individuals who ultimately control or profit from the company. The goal is to increase transparency and prevent financial crimes like money laundering.

Who Needs to File?

All domestic and foreign companies doing business in the U.S. are required to report to the Financial Crimes Enforcement Network (FINCEN). This applies to LLCs, corporations, and similar entities that are registered to operate in the U.S. Exemptions exist for large operating companies and regulated entities, but most small to mid-sized businesses will need to file.

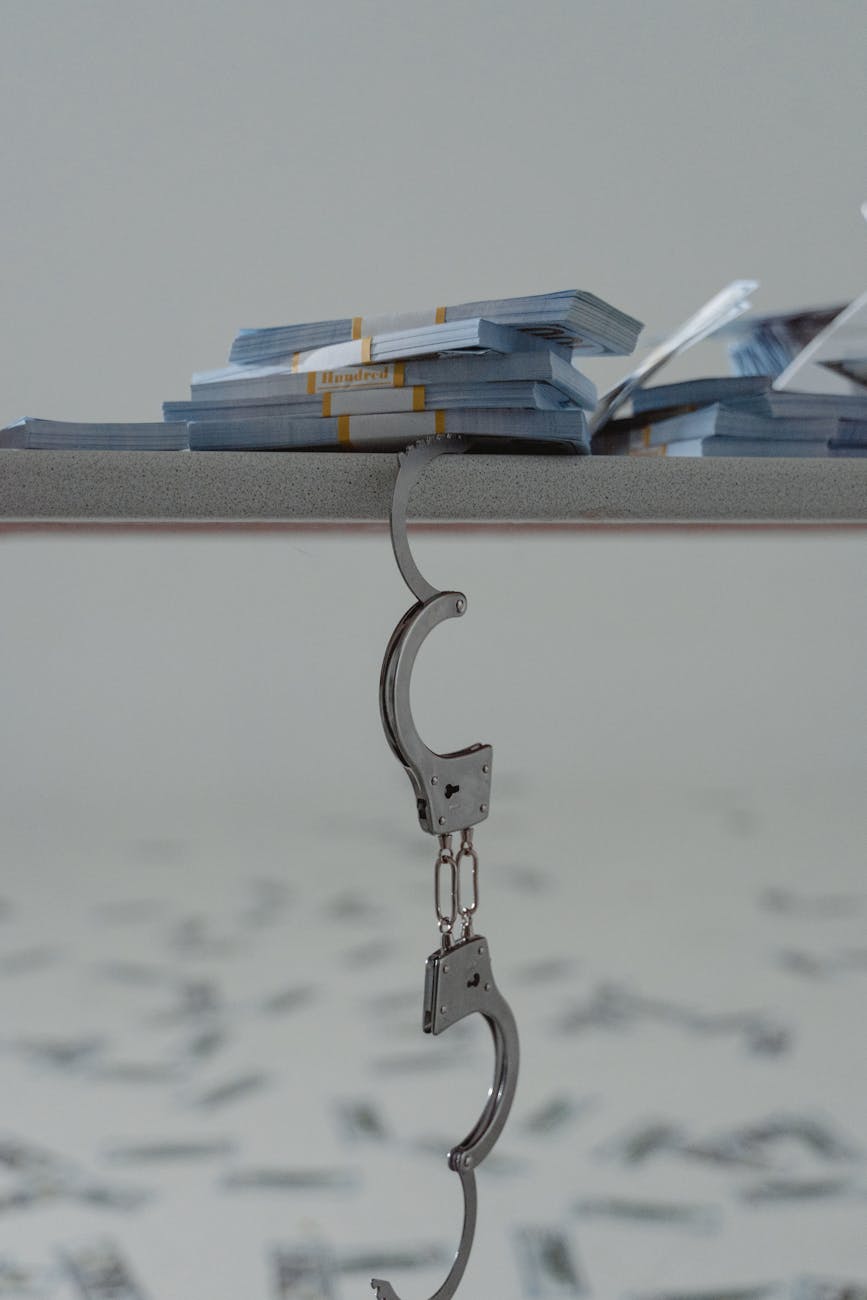

Penalties for Non-Compliance

Failure to comply can result in severe penalties. Businesses that don’t file the required BOI reports can face fines of up to $500 per day, or roughly $18,000 per month. In more serious cases, individuals could face up to two years in prison for willfully failing to report.

Legal Challenges

The BOI requirement has faced constitutional challenges in several states, including Texas, where courts have ruled that the rule could violate privacy rights. However, these rulings are under appeal, and the outcome of these cases could affect the future enforcement of the regulation.

Conclusion

Businesses must be aware of the January 1, 2024 deadline and ensure they comply with the BOI reporting requirements. Failure to do so could lead to significant fines or criminal penalties, and ongoing legal challenges may reshape the regulation’s future.